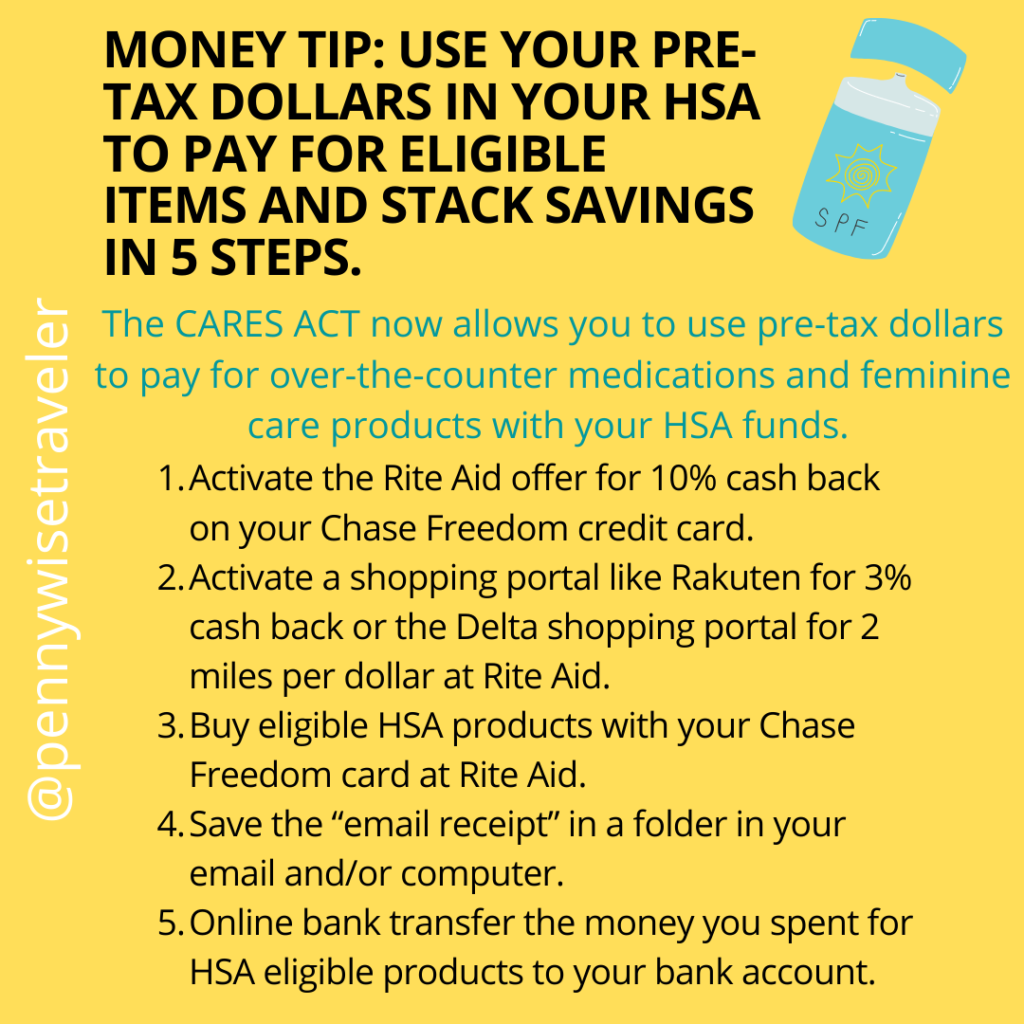

#HEALTHSAVINGS in 5 simple steps with your Health Savings Account (HSA) with pre-tax dollars!

The CARES Act now allows you to use your health savings account (HSA) to pay for over the counter medications and feminine care products.

A HSA is a financial account that can be used to save money for future medical expenses that your insurance with will not cover. You must have a high deductible health plan to qualify for an HSA.

You can also use your HSA to set aside money for retirement. Some HSA accounts even let you invest in mutual funds, ETFs or even individual stocks.

The 2020 limits for a HSA are $3,550 for individual coverage and $7,100 for family coverage.

Unlike a Flexible Spending Account (FSA) you can enroll in an HSA at anytime. Just contact your HR department. You can also get a free HSA on your own at Lively or Fidelity.

Luckily you can “reimburse” yourself for an HSA expense if you do not use your HSA card to pay for an expense. You can use an “online bank transfer” to transfer money from your HSA your own checking or savings account.

Examples of new eligible HSA products include cold remedies, tampons, pads, acne treatment, allergy relief, heartburn, sunscreen that is SPF 15+ that protects UVA and UVB protection, bandages, anti diarrhea medicine, and antacid.

Please see below for the 5 Steps you can do to stack savings on HSA eligible products. Please note, at this time of the posting Chase is offering a 10% cash back offer at Rite Aid until Sunday, May 31, 2020.

How to Stack and Maximize your Pre-Tax HSA Benefits

- Activate the Chase offer for 10% cash back on your Chase Freedom credit card at Rite Aid.

- Activate a shopping portal like @rakuten for 3% cash back or if you want miles the Delta shopping portal for 2 miles per dollar for Rite Aid.

- Buy eligible HSA products with your Chase Freedom card, and spend $34.99 at Rite Aid to get free shipping.

- Save the “email receipt” in a folder in your email and/or computer.

- Online bank transfer the money you spent for HSA products to your bank account.

Also bonus! If you decide to go in person to buy items at Rite Aid (instead of shopping online through a shopping portal) use any coupons, and look for deals on Ibotta. And of course, scan your receipt to Fetch Rewards to stack for more savings.

Please feel to share, comment, or to tag a friend that might find this helpful. Thank you!

One Reply to “HSA Account 5 Steps to Maximize Pre-Tax Dollars”